Nova Scotia buyers put down $100K less than in British Columbia

July 6, 2021

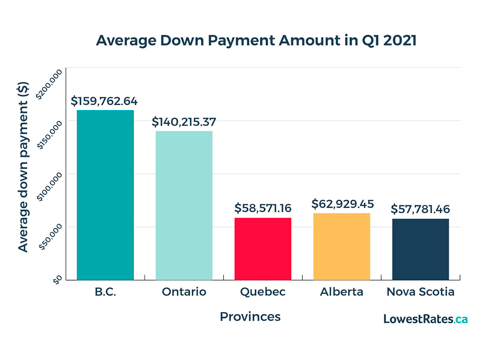

Homebuyers in Nova Scotia and Quebec are paying the lowest down payments in the country—both about $100,000 less than in British Columbia, the province with the highest down payments, according to a new survey from LowestRates.ca.

The study, released June 29, tracked the equity homebuyers put down during the first quarter of 2021.

B.C. homebuyers put down an average of $159,762, while Nova Scotia and Quebec buyers put down an average of $57,781 and $58,571, respectively. Ontario buyers put down $140,215 on average, or 20.35 per cent of the purchase price of $866,307.

The average composite home prices in B.C. and Quebec are $916,741 and $449,698, respectively, according to the Canadian Real Estate Association. Nova Scotia has an average home price of $363,330.

Nova Scotia is an interesting case. It jumped to an 18.54 per cent average down payment, up from 14.26 per cent reported between April and September 2020. RateSpy suggests this is because of an increase in out-of-province buyers in 2021.

In Alberta, where the average home price is $442,808, the typical homebuyer puts down an average of less than $63,000, the study found.

The average down payments in Ontario and B.C. remained around 20 per cent because the average home price in those provinces is close to $1 million. A home worth $1 million or more is not eligible for Canada Mortgage and Housing Corp. (CMHC) mortgage insurance, so the down payment must be at least one-fifth of the purchase price, RateSpy noted.

Tighter lending rules, such as the revamped mortgage stress test, aren’t slowing the Canadian real estate market which is expecting a record-breaking 2021, the report added.

According to the most recent forecast from CMHC, the number of homes sold in 2021 could reach 602,300, up from around 550,000 in 2020.

This could drive the average home price in Canada up about 14 per cent this year, according to LowestRates.ca.

LowestRates.ca CEO and co-founder, Justin Thouin, forecast that historically low lending rates will remain in effect this year. However, Thouin predicts borrowing costs will rise in the second half of 2022 as the economy recovers.